By Eliana Levine, Larina Maira Laube, Lorraine van Ninjen, Vani van Nielen, Zhaoyu Zhu, Paloma Guerra and Alex Sogno.

Our industry is currently at a standstill. There is no previous precedent, no historical data to refer to. Revenue Management (RM) systems do not have reliable data to process – they will not work. Most of your positions as Revenue Managers probably did not exist yet during the 2008 Financial Crisis. And you did not expect to handle nor know how to deal with a crisis of this extent. How do you move forward? How can a hotel use RM effectively in a market with little supply and nearly no demand? Here is the solution.

As the crisis subsides, travel bans are lifted, and hotels begin to reopen, it is essential to be aware of where your market lies in comparison to pre-COVID-19 levels. This article will offer critical metrics and trends that Revenue and Hotel Managers should pay attention to now, to be prepared for your hotels’ reopening and rate recovery strategy. The metrics will outline how you can track your changing guest mix as well as offer benchmarks for your pricing strategy. Some of the metrics presented are available in public sources; meanwhile, others require a paid subscription or need to be performed individually according to private and financial related data. All of them, however, are worth taking into consideration for the foreseeable future.

1. RADAR Average Reports (Private)

Understanding how the market is responding to increasing demand will be one of the most important metrics to follow. We are partnering up with Robert Hernandez from Origin World Labs (OWL), to track rates in ten key markets. As hoteliers, we often compare to our competitive set, whereas guests are looking at the entire market when selecting a hotel online. OWL’s RADAR Reports show revenue managers where the rates fall within your market and tell if you are in line with your star category (rate buckets), or if you are falling above or below your segment and into another bucket. As your hotel recovers, it is crucial to price within your respective bucket and not to overshoot the market. During recovery, every reservation will count, and overpricing your room rates could lead to unfavourable occupancies.

2. Website Searches (Private)

The number of visits your website receives is an excellent indicator of demand. As consumers nowadays are presented with so many different options and are extremely reliant on the internet, they will be sure to check out your website before making a reservation. Properties can use their analytics service to track their website traffic. It will give you information based on date and location, which you can then use to benchmark your largest markets year-on-year. You can also use the location feature to see where the searches are coming from and target those markets with Google ads. If your property is part of a larger management company with a centralised platform, find out what resources are available to you and what information they have at a corporate level.

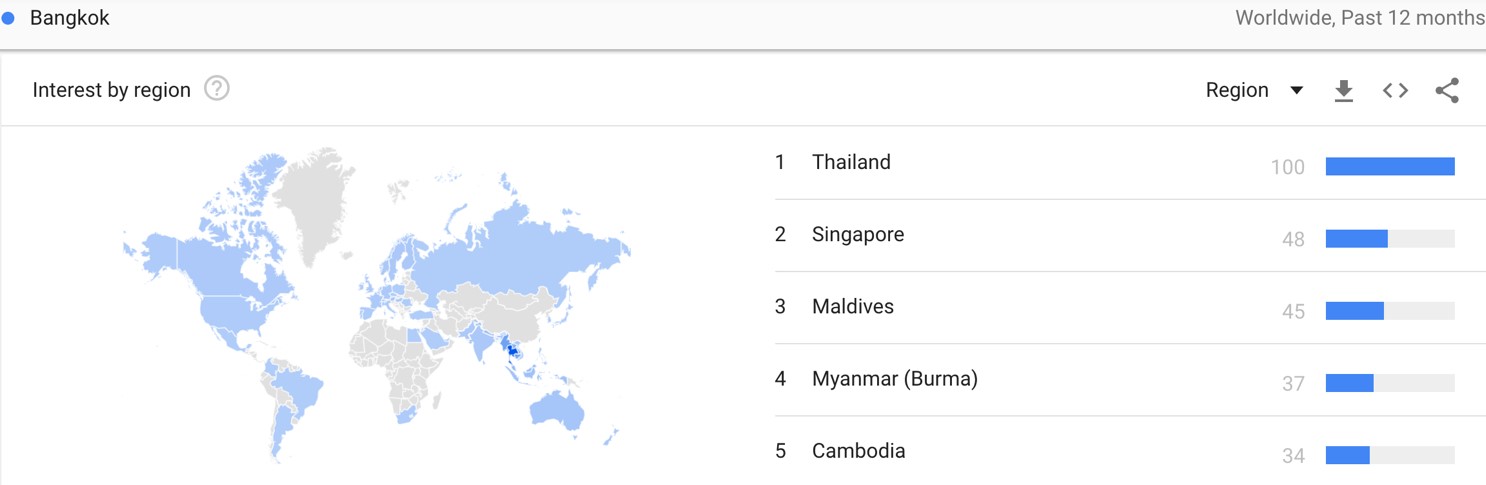

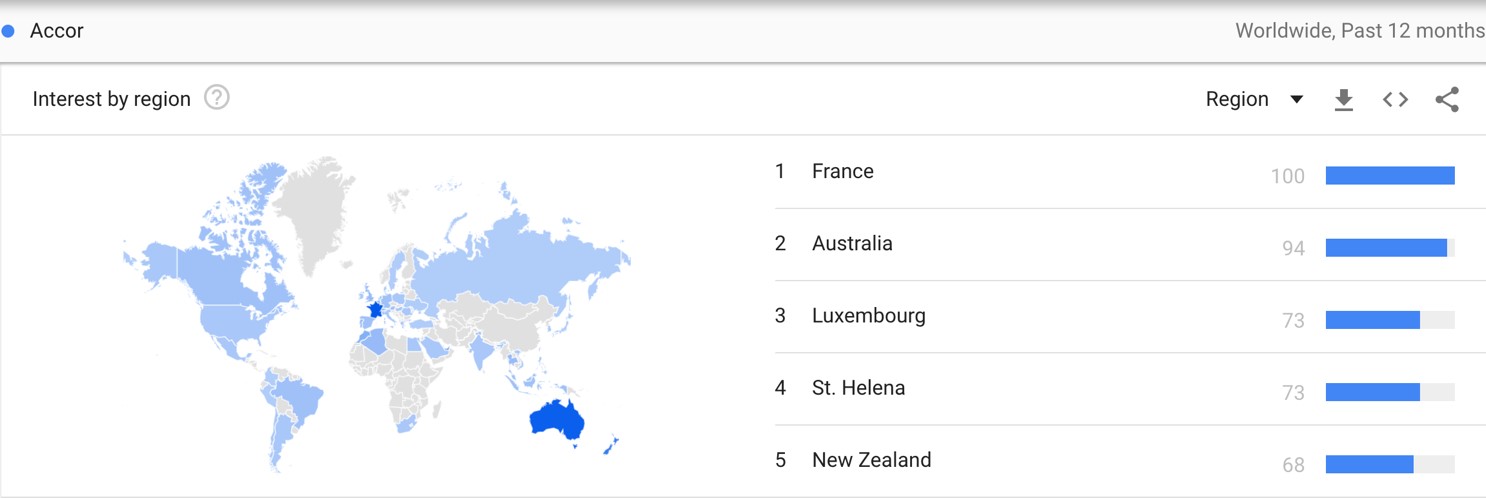

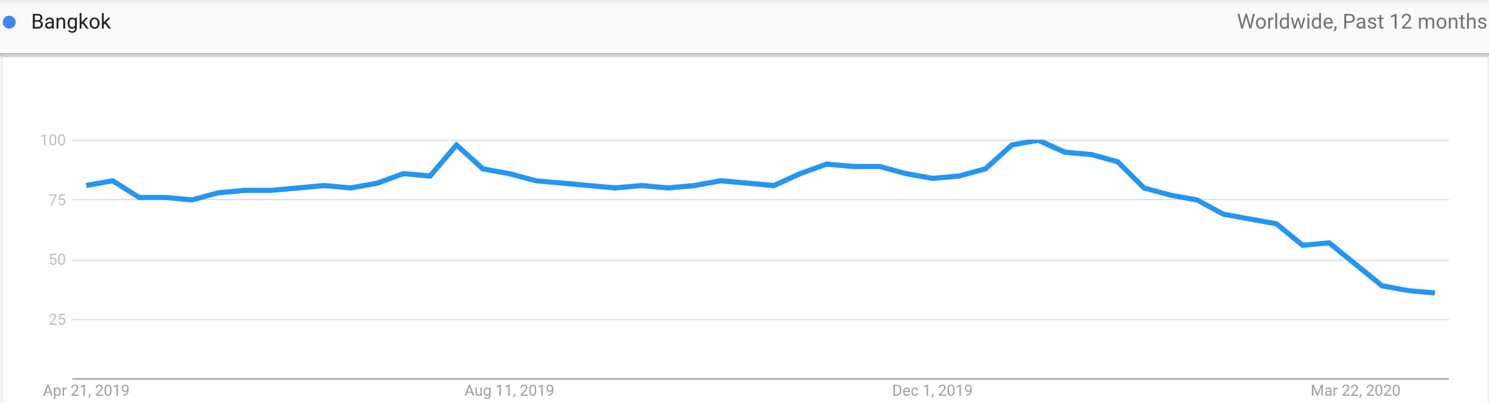

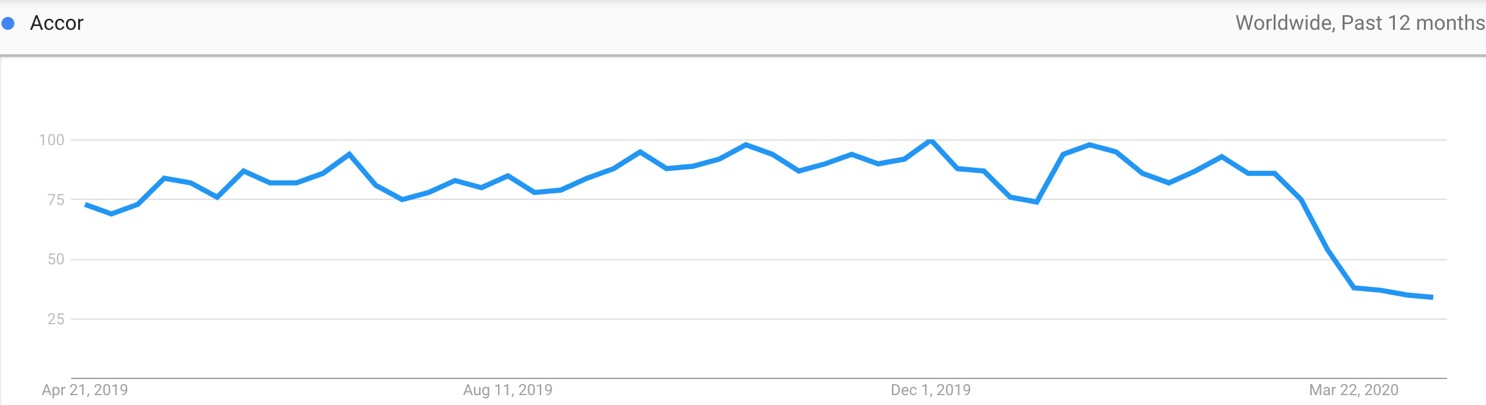

Google trends also allow professionals to track popular services and experiences, to help adapt the product to be most relevant for the target guest. This tool can help differentiate which outlets and amenities to offer upon re-opening from which ones should remain unavailable as a cost-saving measure. This can then help develop the price mix strategy.

Figure 1

Figure 2

Figure 3

Figure 4

3. Airline Traffic and Travellers’ Information (Public and Private Respectively)

The changing number of airline routes and flights is also a great indicator of demand. Monitor this closely as more and more flights are cancelled each day due to the declining demand as travel bans remain and airlines consolidate their routes. Moreover, as the crisis goes down, and travel begins to increase, this will be a great tool to monitor returning demand to your region. It can also control what regions and cities your customer is most likely to come from, given the gradual lifting of travel bans and consumers’ behaviour.

Sales & Marketing can use this information to channel the target market in these locations. There are several sources to help revenue managers monitor this, such as various airport websites or FlightRadar24, which shows all planned airport arrivals every week and ForwardKeys. The latter is a big data company that analyses forecast arrivals and travellers’ spending patterns in target cities, disclosing data to better design the business segmentation.

4. Virus Evolution by Target Market (Public)

Track the virus spread and the effectiveness of the public health response. The stock market fluctuated according to the population’s infection rate and available tests in the region. The rate and progress of the infection will impact consumers’ timeline and location of travel. Therefore, design a strategy based on the recovered segments and where your demand is likely to come from. You can adapt this to your hotel by tracking your likely consumer market. The World Health Organisation is the official institution to track and monitor COVID-19’s impact on the population.

5. Economic drivers (Public)

While forecasting demand is essential, the data and predictions will remain volatile until new worldwide travel policies are instituted. Monitoring both strong and weak market signals can indicate when a potential recovery is likely. Data indicates that the local market will lead the demand once the lockdown restrictions are lifted.

Monitor the economic effects proactively, it will strengthen revenue managers argument to defend the price mix strategy, by either maintaining the pre-COVID-19 price levels or to apply discounts for recovery.

The GDP and Purchasing Managers Index are published in a variety of different places depending on the country. Trading Economics is also a reliable resource used by investors. The Unemployment Rate trends are published in the statistics area of local government websites.

Foreign Exchange Rates (Fx) can be used as a determinant of your changing guest mix and guide what your new target market will be. For example, as the Euro to USD exchange now lies around 1.09 (Figure 3 above), it is now cheaper for Americans to travel to Europe, but the reverse for Europeans. Assuming this trend continues, when the crisis is over, there may be increased European and American travel within Europe and decreased European travellers in the US, therefore changing your guest mix.

Your Sales & Marketing team can use this information to channel your changing target segment. Fx can also be used as an essential metric to guide your pricing strategy. They can be used as a good indicator of where you can price your room rates in comparison to pre-crisis levels, especially for international travel. Keep track of the foreign exchange rates through bank websites to understand and modify your pricing levels accordingly and predict changes in your guest-mix.

6. Customer Relationship Management (CRM) (Private)

In addition to managing your pricing strategy, running demand forecasts, and developing new methodologies to optimise the RM system, at the end of the day, the loyal customers will be crucial for business continuation. It is essential to monitor customer satisfaction and retain the most valuable asset in the business, the clients.

Ensure the reservation department is available to answer any enquiries submitted by customers via e-mails, phone calls, reviews in social media, or letters. Create a report to differentiate between cancellations, modifications, complaints, general questions, new reservations and so on.

CRM systems can be used to follow changes during this time. You can evaluate recovering occupancies by tracking reservation modifications (instead of cancellations) and observe when the number of reservations has returned to pre-crisis conditions.

Lastly, the Revenue Management, Sales & Marketing, & Finance teams should work together to determine the cost of obtaining new clients compared to retaining current ones. This is a private metric that depends on the business budget and spending capacity. This should then be taken into consideration when developing the new pricing strategy.

This article was provided by Global Asset Solutions and republished with permission. To read the source version, including source references, please CLICK HERE.